The car title loan industry (Car Title Loan Industry News) faces scrutiny for predatory practices in Dallas, where high-pressure sales and hidden fees trap borrowers in debt. Consumer advocacy groups push for regulations to protect borrowers from high-interest rates and harsh collection methods, aiming for fair lending practices. Regulatory changes focus on stringent loan requirements, enhanced verification, transparent communication, and preventing overindebtedness, transforming the industry (Car Title Loan Industry News) and demanding lenders' adaptation.

“The car title loan industry, a lucrative yet contentious sector, finds itself at the center of a fierce battle. Uncovering Industry Disputes sheds light on the delicate balance between lenders and consumers. As consumer protections become paramount, we explore fair practices in lending. Additionally, recent regulatory changes drastically shape the future of car title lending. Stay informed about the latest industry news and its impact on both lenders and borrowers.”

- Uncovering Industry Disputes: Loans and Lenders in Focus

- Consumer Protections: A Battle for Fair Practices

- Regulatory Changes: Shaping the Future of Car Title Lending

Uncovering Industry Disputes: Loans and Lenders in Focus

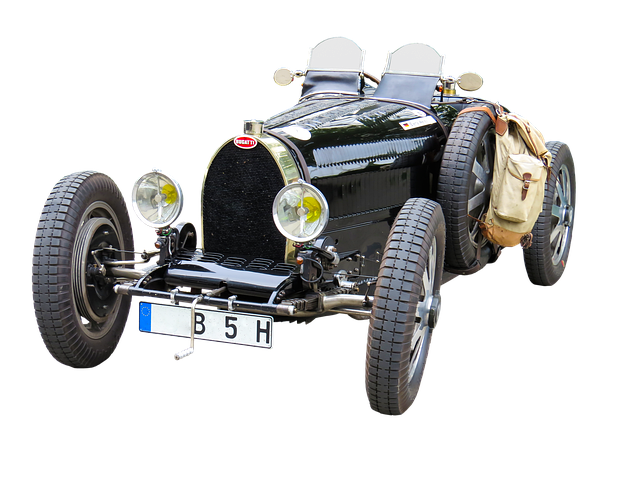

The car title loan industry has been a hotbed of controversy and dispute for many years, with borrowers often finding themselves entangled in complex financial situations. As Car Title Loan Industry News continues to gain traction, the spotlight shines brightly on the practices and procedures employed by lenders. At the heart of these debates lies the Title Loan Process, where borrowers use their vehicle titles as collateral for short-term loans. In many cases, these loans come with steep interest rates and terms that can trap individuals in cycles of debt, making it challenging to repay and ultimately leading to vehicle repossession.

One particular region that has been under intense scrutiny is Dallas, Texas, known for its thriving Dallas Title Loans market. Here, borrowers often seek quick cash solutions, but the high-pressure sales tactics and hidden fees associated with these loans have prompted consumer advocacy groups to call for greater regulation. The complex web of loan payoff options and their potential consequences highlight the need for borrowers to be well-informed. As news and awareness spread, consumers are increasingly demanding transparency and fair practices within the car title loan industry.

Consumer Protections: A Battle for Fair Practices

In the fast-paced car title loan industry news, consumer protections have emerged as a fierce battleground. Advocates argue that stringent regulations are necessary to safeguard vulnerable borrowers from predatory lending practices. These include excessive interest rates and aggressive collection tactics that can trap individuals in cycles of debt. By implementing robust credit check mechanisms and transparent fee structures, regulators aim to ensure fair practices within the industry.

The debate rages on how much protection is enough while still allowing legitimate lenders to operate effectively. Proponents of consumer protections emphasize the need for borrowers to understand the terms of their loans, including the implications of defaulting on payments. They argue that a balanced approach that considers both borrower rights and lender sustainability is crucial for long-term stability in the car title loan industry news.

Regulatory Changes: Shaping the Future of Car Title Lending

The car title loan industry has been undergoing significant transformations due to regulatory changes that are reshaping its future. These shifts are driven by a need to protect consumers and ensure fair lending practices, particularly for secured loans like car title loans, where borrowers use their vehicles as collateral. One of the key developments involves stricter loan requirements, including enhanced verification processes and clearer terms and conditions, which aim to prevent predatory lending and overindebtedness.

Additionally, regulatory bodies are pushing for more transparent communication about interest rates, fees, and repayment terms, with a focus on ensuring direct deposit of funds into borrowers’ accounts. These measures not only empower borrowers by providing them with better control over their finances but also foster trust in the car title loan industry. As regulations continue to evolve, lenders must adapt to meet these new standards while competing in an increasingly regulated market, keeping up with industry news will be crucial for staying ahead.

The car title loan industry has been a focal point of debate, with disputes between lenders and consumers highlighting the need for regulatory changes. As industry news continues to evolve, implementing fair practices and consumer protections is crucial for shaping a more transparent and safe borrowing experience. Understanding these dynamics is essential for both borrowers and lenders as we navigate the future of car title lending.